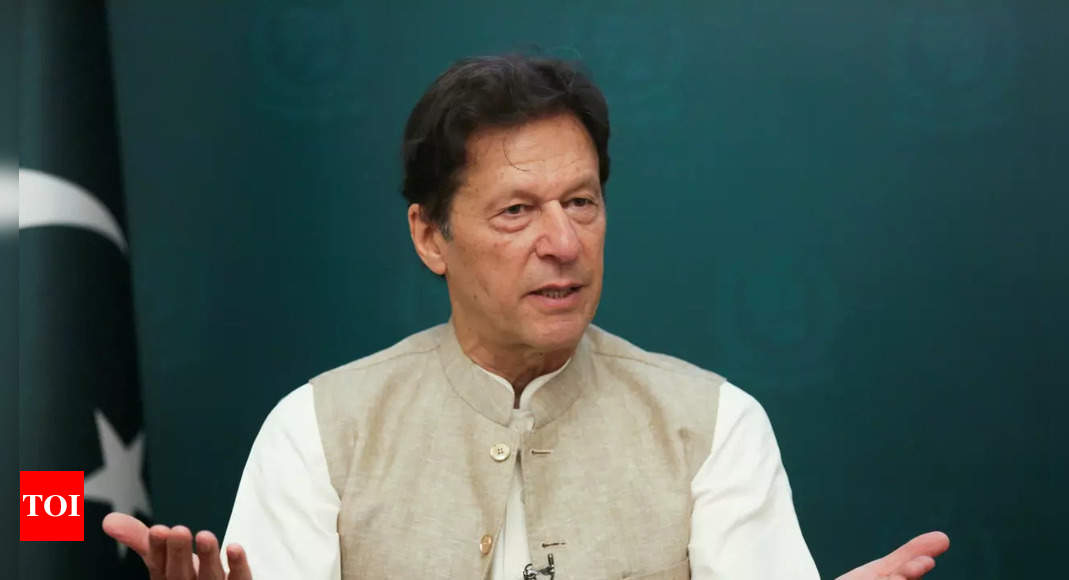

imf: PM Imran’s govt left with no option but to yield to IMF programme – Times of India

[ad_1]

According to senior government officials, top authorities in the finance ministry have decided to consult with Prime Minister Imran Khan to devise a new strategy to introduce legislation mandated by the IMF to resume a suspended $6 billion extended fund facility (EFF).

The IMF has linked resumption of loans to parliamentary approval for the passage of two key bills — the Tax Laws (Fourth) Amendment Bill and the State Bank of Pakistan (SBP) Autonomy Bill.

The Tax Laws (Fourth) Amendment Bill envisions the withdrawal of GST exemptions on hundreds of commodities in a bid to boost tax revenue by an estimated Rs 350 billion (Pakistani rupees). The government fears that imposing these new taxes at this stage — when inflation in November was reported at 11.53% — might provoke a strong public backlash. The SBP Autonomy Bill, meanwhile, would grant the central bank independence in all matters of monetary policy, the exchange rate, and recruitments. The government believes that due to strong political opposition it won’t be possible for the ruling party and its allies to pass the bills in parliament.

Knowing its limitations, the government has been attempting to convince the IMF that it will introduce a mini-budget and change the laws through a presidential ordinance — a common practice in the incumbent government.

In addition to the withdrawal of tax exemptions and autonomy for the central bank, the IMF has also been pushing the government to reduce the public sector development programme by Rs 200 billion, bringing it down to Rs 700 billion.

Meanwhile, the Saudi government has deposited a $3-billion loan with Pakistan to boost its foreign exchange reserves but it is also reliant on Islamabad remaining under the IMF programme. The terms of agreement, which are no longer confidential, allow Riyadh to withdraw the sum within 72 hours if Islamabad abandons the IMF programme.

[ad_2]

Source link

Comments are closed.